Insurance Companies in Germany – Top Providers for Expats and Locals

Discover the best insurance companies in Germany for health, car, life, and property coverage. Learn about Allianz, ERGO, AXA, and more to find the right protection for your needs.

Why Insurance is Important in Germany

Germany has one of the most developed insurance markets in the world. Health insurance is mandatory for everyone, and car insurance is legally required if you own a vehicle. Other types such as life, home, or liability insurance are highly recommended for extra protection.

If you are planning to live, work, or study in Germany, understanding the major insurance providers can help you make the right decision.

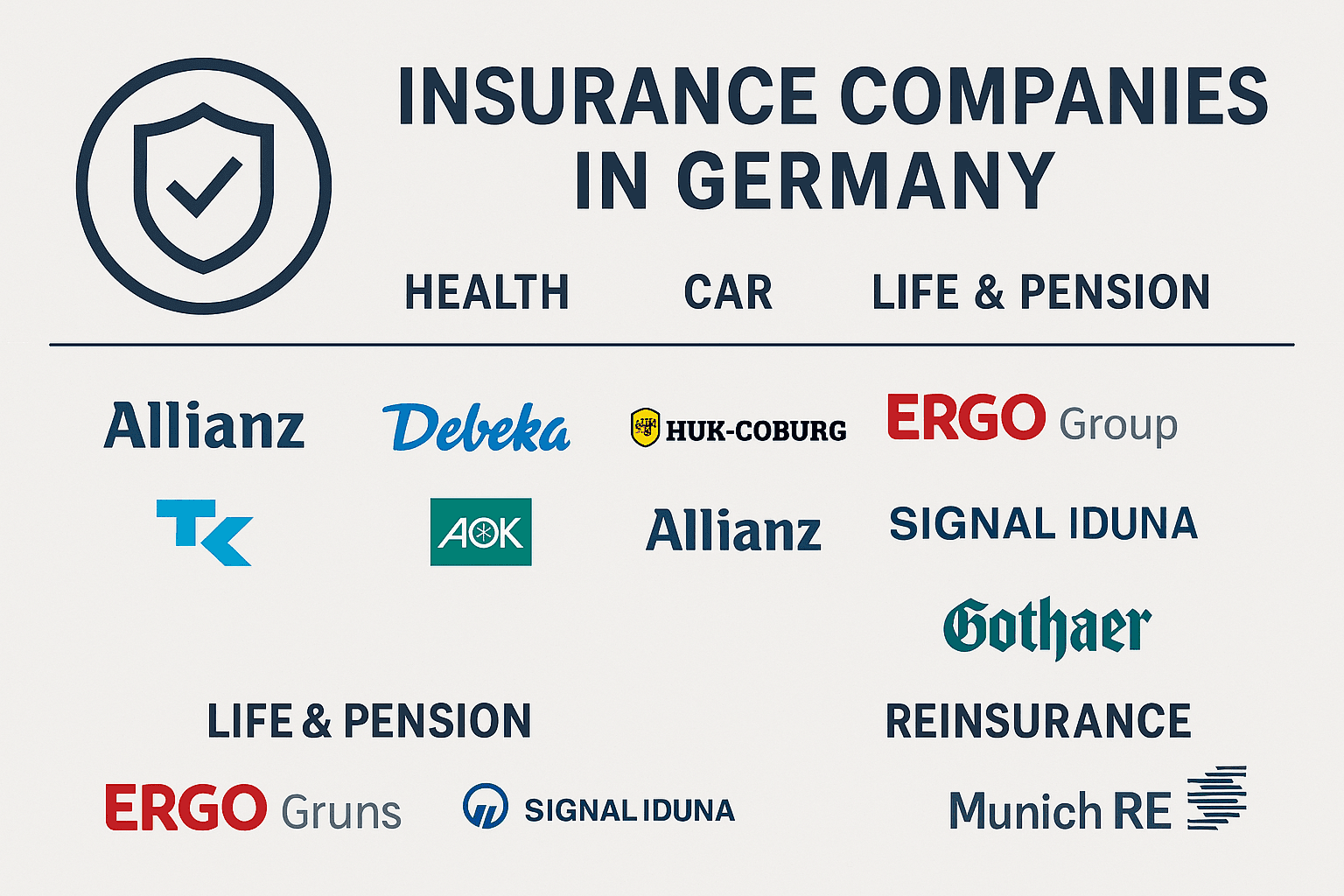

Health Insurance Companies in Germany

Health insurance (Krankenversicherung) is divided into public and private providers. Expats often need to choose carefully depending on their job and residence status.

– Allianz – Offers private health insurance options for professionals and expats.

– Debeka – Strong in private health insurance.

– TK – Techniker Krankenkasse – One of the largest public health insurance companies.

– AOK – Widely available and popular among students and employees.

Car Insurance Providers in Germany

Car insurance (Kfz-Versicherung) is compulsory for every driver in Germany.

– HUK-COBURG – Well-known for affordable car insurance.

– AXA Germany – Offers flexible car and liability insurance.

– Allianz – Strong coverage with additional services like roadside assistance.

– R+V Versicherung – Popular among customers of Volksbanken and Raiffeisenbanken.

Life and Pension Insurance

Life insurance (Lebensversicherung) and pension schemes are very important in Germany for long-term financial security.

– ERGO Group – Provides a wide range of life and retirement products.

– Signal Iduna – Strong in pension and health insurance.

– Gothaer – Traditional provider with long experience in life insurance.

Reinsurance Giants in Germany

Germany is also home to some of the world’s largest reinsurance companies:

– Munich Re (Münchener Rückversicherung) – Global leader in reinsurance.

– Hannover Re – One of the top reinsurance groups worldwide.

Choosing the Right Insurance Provider

When selecting an insurance company in Germany, consider:

– Type of coverage you need (health, car, life, liability)

– Whether you qualify for public or private insurance

– Price vs. benefits

– Language support for expats

Conclusion

Germany offers a wide range of insurance options, from public health funds to global giants like Allianz and AXA. Whether you are a student, employee, or entrepreneur, having the right insurance ensures security and peace of mind.